Self Storage Pre-Construction Planning

Introduction: Why Pre-Construction Planning Matters for Self Storage REITs

If you’re part of a REIT acquisitions, asset management, or development team planning multi-story self storage projects for 2024–2026, the decisions you make during pre-construction will determine most of your project’s financial outcome. The site selection, entitlement strategy, structural choices, and pro forma assumptions locked in 12–24 months before opening will effectively cement your IRR and yield-on-cost—long before the first tenant signs a lease.

When undertaking a storage construction project, careful planning, project management, and market considerations are essential to ensure the successful execution and profitability of your self storage facility.

Multi-story urban and dense-suburban facilities have become the dominant product type for institutional-grade self storage development. These 3–5 story, climate controlled, elevator-served buildings require a different playbook than the single story facilities of previous decades. With typical project sizes ranging from 80,000 to 140,000 net rentable square footage and development timelines spanning 18–30 months from site control to Certificate of Occupancy, the margin for error in the development process has narrowed considerably.

The self-storage industry generates over $30 billion annually in the United States, driven by urbanization and smaller living spaces. Self-storage facilities are also considered recession-resistant assets due to consistent demand for storage solutions.

Storage Building Company (www.storagebuildingcompany.com) specializes in multi-story self storage construction and can engage as early as land contract or letter of intent to support underwriting and pre construction planning. This article provides a step-by-step pre-construction roadmap—from feasibility and site control through permitting, schematic design, and pre-GMP budgeting. Whether you’re evaluating your first multi story facility or your fifteenth, the framework outlined here will help you avoid the pitfalls that inflate construction costs and delay stabilization. When you’re ready to move forward, contact Storage Building Company to review your next project.

Step 1: Define the Investment Thesis and Project Program

Before engaging architects or civil engineers, REITs should lock in a clear, written investment thesis that defines the target market, tenant profile, hold period, and exit strategy. This document becomes the foundation for every design and construction decision that follows.

Target NRSF: Specify the desired net rentable square footage range (e.g., 90,000–120,000 NRSF) based on site capacity and market absorption rates

Unit mix parameters: Define the percentage of climate controlled units, locker units (5x5, 5x10), standard units (10x10, 10x15), and larger commercial units (10x20, 10x30) based on the target tenant profile

Amenity and quality level: Distinguish between premium urban facilities with architectural façades and retail-quality finishes versus value-focused suburban projects with optimized construction methods

Pro forma assumptions: Align stabilized occupancy targets (typically 85–92%), rental rate assumptions, and lease-up velocity projections with current 2023–2025 self storage industry performance data; include sensitivity analyses for interest-rate volatility and cap rate compression scenarios

Brand standards documentation: Define façade quality requirements, glass and architectural features, signage strategy, loading zone design, office size, parking counts, and technology stack (keyless entry, app-based access, unmanned or hybrid operations)

Operational model alignment: Determine whether the new self storage facility will operate with on-site management, hybrid staffing, or fully remote operations—this directly impacts building design and MEP requirements

Storage Building Company can facilitate an initial “programming workshop” with REIT development, operations, and construction teams to reconcile operational preferences with construction cost and schedule impacts before design starts. These sessions typically occur in the first 30–60 days of a project and prevent costly mid-design revisions.

Step 2: Site Selection, Due Diligence, and Entitlement Risk

For multi-story self storage, site selection priorities differ fundamentally from single story facilities. Raw acreage matters less than visibility, access quality, height allowances, and entitlement timing—particularly in constrained MSAs where the right location can make or break a project’s economics.

The development team should target infill or near-infill locations within 3–5 miles of dense residential rooftops. High traffic counts (20,000+ vehicles per day when possible), strong multi-family inventory nearby, and clear access for moving trucks are essential characteristics. Sites near apartment communities with smaller living spaces often generate premium rental rates due to consistent local demand for storage.

Due Diligence Tasks (First 45–90 Days of Site Control):

Commission ALTA survey to identify easements, encroachments, and boundary issues

Complete Phase I Environmental Site Assessment; proceed to Phase II if recognized environmental conditions exist

Conduct geotechnical investigation and soil testing to assess bearing capacity, groundwater levels, and proper drainage requirements

Confirm utility capacity (water, sewer, electric, gas, telecom) with local providers; identify any required upgrades or extensions

Hold preliminary conversations with planning staff to gauge receptivity and identify potential red flags

Review stormwater management requirements and infiltration testing results

Zoning and Entitlement Review:

Confirm self storage is a permitted use in the zoning classification, or identify the variance/special use pathway required

Verify building height limits (typically 45–65 feet for 3–5 story construction)

Assess floor area ratio (FAR) limits and maximum impervious coverage caps

Identify any moratoria, overlay districts, or pending code changes that could affect approvals

Research recent self storage projects in the jurisdiction to understand precedent and processing times

When evaluating storage facility projects, consider how planning and financing activities may differ across regions, as local requirements and funding options can significantly impact project structure and timelines.

Entitlement timelines vary dramatically by market. Many Sunbelt cities process site plan approvals in 6–9 months, while coastal or high-barrier municipalities may require 12–18+ months including public hearings. Factor these timelines into your capital deployment schedule and earnest money decisions.

Storage Building Company can review test fits during due diligence to quickly validate whether a target site can support the REIT’s program—including required rentable square footage, parking, stormwater management, and fire department access—before earnest money goes hard.

Self Storage Acreage and Density for Multi-Story Facilities

For REIT-grade multi story facility development in 2024 and beyond, density matters more than raw acreage.

Compact sites (1.0–1.75 acres): Can often support 90,000–120,000 GSF multi-story buildings with efficient design, particularly in urban infill locations where land costs are high

Mid-size sites (2–3 acres): Accommodate additional surface parking, stormwater retention, landscape buffers, and potential future expansion or phasing opportunities

Site coverage comparison: Single story facilities typically achieve 30–40% site coverage, while multi-story buildings can reach 60–75% site coverage or be governed primarily by FAR limits. Single-story developments are ideal for larger parcels of land where you can spread out without worrying about maximizing every square foot, making them a practical choice when land is abundant and cost per square foot is lower.

Parking considerations: Structured parking is rarely needed for self storage, but local codes may mandate minimum stall counts that affect achievable NRSF and overall project economics

Drive up access tradeoffs: Some sites may support a hybrid design with ground-level drive up units and upper-floor climate controlled storage, though this adds complexity and cost

Storage Building Company regularly helps investors model NRSF yield per acre on actual parcels under contract across markets including Dallas–Fort Worth, Atlanta, Denver, and Phoenix.

Step 3: Market Feasibility and Competitive Analysis

Market analysis represents the first real gate in pre construction planning. If market demand and achievable rents don’t support the investment thesis, even the best design and construction execution cannot rescue the deal. This critical step validates the entire development process before significant capital is deployed.

Core Feasibility Study Components:

Define the primary trade area (typically 3–5 mile radius) based on population density and competitive positioning

Catalogue all existing and planned storage facility inventory, including REIT-owned properties, regional operators, and new developments in the pipeline

Assess current occupancy levels by facility and unit type; identify submarkets showing signs of oversupply

Analyze street rates and asking rents by unit size and feature set (climate controlled vs. standard, interior vs. drive up units)

Examine demographic trends: population growth, household formation rates, median income, renter-to-owner ratios, and housing unit sizes

Data Points to Anchor Your Analysis (2023–2025):

Stabilized occupancies in healthy markets typically range from 85–92%

U.S. self storage demand grew 5–7% annually pre-2023; growth continues but varies significantly by submarket

Climate controlled facilities often command 15–25% rent premiums over standard units

Multi-story comprises approximately 20–30% of new supply in major metros

Feasibility Impact on Program Refinement:

Urban sites with dense apartment inventory may warrant shifting unit mix toward smaller units (5x5, 5x10 lockers) that serve renters with limited possessions

Outer-ring suburban locations with small business demand may need more 10x20 and 10x30 units for commercial users

Market research showing competitive oversupply may require adjusted pricing assumptions, extended lease-up projections, or walking away from the site entirely

Lease-Up and Financial Modeling:

Model realistic lease-up duration: 24–36 months is typical for institutional multi-story facilities to reach stabilization

Factor carry costs (debt service, property taxes, insurance, minimal operating expenses) during lease-up into your pro forma

Ensure lease-up projections align with DSCR covenants required by construction lenders

Storage Building Company can collaborate with feasibility consultants and REIT internal research teams to test how design and phasing choices affect rentability and revenue potential across different market scenarios.

Step 4: Zoning, Approvals, and Code Compliance Strategy

For many self storage REIT projects, the approvals calendar—not construction duration—determines the critical path. A successful self storage project requires navigating zoning pathways and building codes with the same rigor applied to financial underwriting. Delays at this stage can add 6–12 months and inflate development costs by 10–20%.

Zoning Pathways and Approval Strategies:

By-right approvals: Fastest path when self storage is a permitted use; focus shifts to staff-level site plan review

Conditional/Special Use Permits (CUP/SUP): Require public hearings and planning commission approval; add 3–6 months minimum

Planned Development overlays: May offer flexibility on height or density in exchange for enhanced architectural standards

Variances: Required when project parameters exceed code limits (height, setbacks, FAR); often contentious and time-consuming

Key Building Codes Affecting Multi-Story Self Storage:

IBC occupancy classifications (typically S-1 low-hazard storage)

Fire ratings between corridors and individual self storage units

Sprinkler system requirements throughout the building

Egress design including stair core placement, travel distances, and exit signage

ADA accessibility requirements for office areas, ground-floor units, and common spaces

Elevator code compliance including cab sizes, emergency power, and maintenance access

Fire Department Coordination (Often Surfaced Early):

Fire department access road widths and turning radii around the building perimeter

Aerial apparatus access requirements for buildings over 30 feet

Hydrant locations and flow capacity verification

Fire wall placement in buildings exceeding code length limits

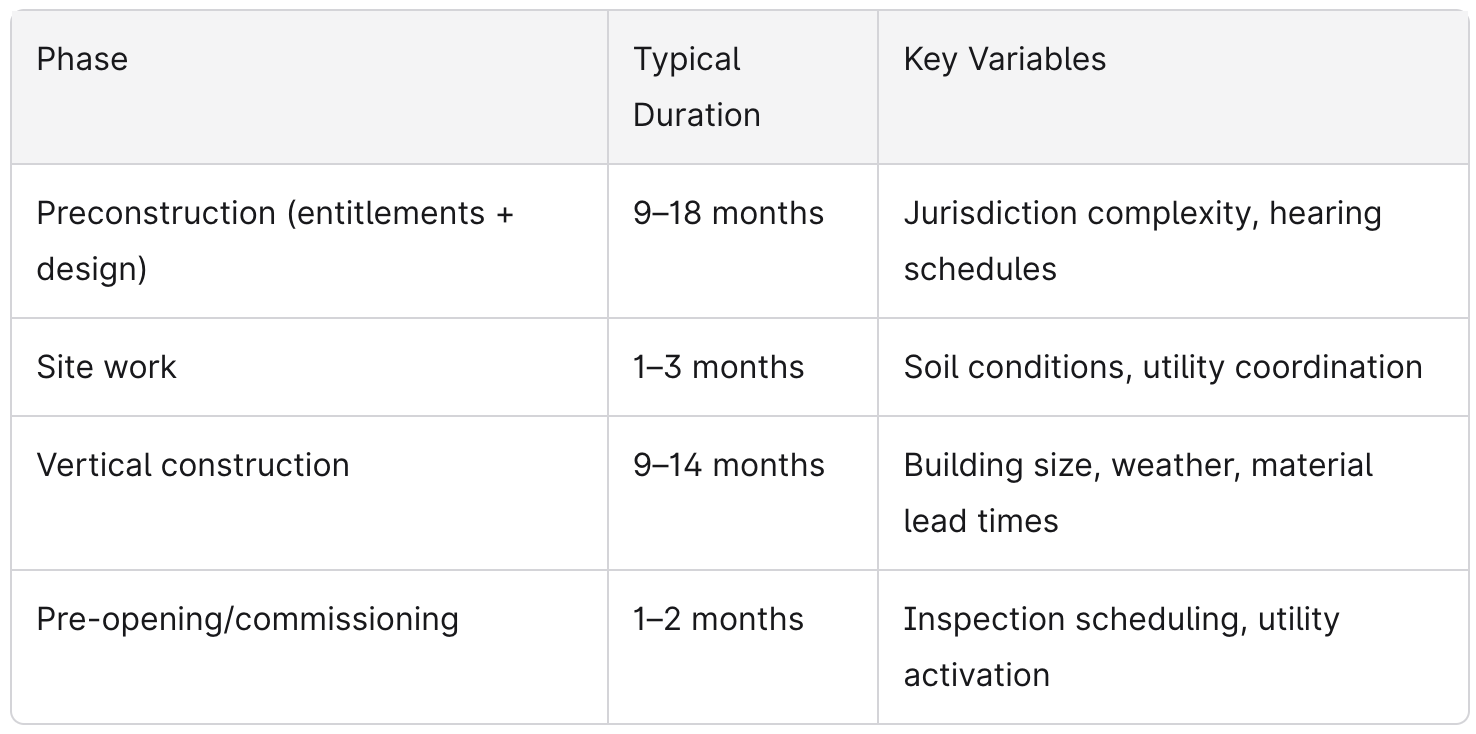

Typical Permitting Timeline Ranges

Storage Building Company’s pre-construction team can coordinate closely with REIT counsel, land-use attorneys, and local consultants to sequence submittals correctly and avoid re-design cycles that add months to the construction timeline.

Step 5: Concept Design, Structural Systems, and Unit Mix Optimization

Once entitlement risk reaches tolerable levels, the focus shifts to translating the business plan into a building that maximizes rentable square footage while meeting codes, constructability requirements, and REIT brand standards. This phase bridges business strategy and physical structure. Multi-story facilities allow you to maximize your rentable square footage on a smaller footprint, making them ideal for urban areas where every square foot is valuable. However, multi-story facilities typically require additional infrastructure, such as elevators and extensive HVAC systems for climate-controlled floors.

Concept/Schematic Design Process:

Block out floor plates to maximize usable area while maintaining efficient circulation

Locate elevator cores, stair towers, and mechanical rooms to minimize lost space

Design loading zones for customer convenience and code-required fire department access

Size and position the office and retail frontage for street presence and operational efficiency

Identify future expansion opportunities or phasing strategies if site permits ample land

Structural System Decisions for Multi-Story Storage:

Pre engineered metal buildings (hybrid systems): Combine structural steel framing with pre-engineered components for cost efficiency; well-suited for 3–4 story buildings. Pre-engineered metal buildings (PEMBs) are an ideal construction method for modern self-storage facilities due to their modular design and durability. Metal building kits provide faster construction timelines, predictable costs, and durable structures that require minimal maintenance. The modular nature of storage unit building kits allows for phased development, enabling expansion as demand grows without major disruption.

Structural steel with cold-formed partitions: Traditional approach offering design flexibility; partitions installed after shell completion

Podium structures: Required for mixed-use urban sites with ground-floor retail or parking; higher initial costs but may be necessary for zoning compliance

Steel framing and steel buildings dominate multi-story self storage construction due to speed, cost, and seismic performance. Pre engineered metal buildings offer particular advantages when construction methods are standardized across a REIT portfolio.

Unit Mix Optimization:

Use actual competitor data and market analysis to determine ideal mix of 5x5, 5x10, 10x10, 10x15, and larger units

The 10x10 unit often remains the “workhorse” across most markets, typically comprising 25–35% of total units

Climate controlled units should represent 50–70% of inventory in competitive urban markets where they yield 15–25% revenue premiums

Consider wine storage, document storage, or business-focused units in markets with demonstrated demand

Circulation and Layout Considerations:

Double-loaded corridors (units on both sides) maximize efficiency but create longer travel distances

Single-loaded corridors may be required at building perimeters for natural light or façade requirements

Elevator count (typically 2–3 for buildings 90,000+ GSF) directly impacts customer experience and operating costs

Include cart staging areas near elevators and loading zones

Avoid long dead-end corridors exceeding code limits and causing poor customer experience

Design electrical systems and HVAC to serve climate control considerations efficiently across all floors

Storage Building Company’s design and pre-construction team can rapidly iterate multiple test fits—comparing 3-story versus 4-story options, or two-elevator versus three-elevator cores—and provide comparative NRSF and budget impacts to support REIT investment committee decisions.

Façade, Branding, and Community Acceptance

Multi-story self storage in visible corridors must often present more like retail or office buildings to gain approvals and meet REIT branding goals. The days of utilitarian mini storage building aesthetics are over in most institutional-grade markets.

Architectural elements: Glazed corners, EIFS or masonry accents, articulated façades, and varied rooflines create visual interest required by many planning commissions

Signage strategy: Design signage that complies with local ordinances while reinforcing national branding; monument signs, building-mounted channel letters, and directional signage must be coordinated early

Neighbor relations: Screen loading areas and dumpster enclosures from adjacent properties; incorporate landscape buffers per code requirements

Lighting design: Specify fixtures that provide security features and customer safety while limiting spillover onto adjacent residential parcels

Traffic studies: Demonstrate that self storage generates far fewer daily vehicle trips than most commercial uses (typically 2–3 trips per 1,000 SF vs. 30–50 for retail), easing traffic concerns

Storage Building Company frequently collaborates with architects to produce visualization packages—renderings, material boards, and presentation graphics—to support planning commission hearings and neighborhood meetings.

Operational Design for Modern, Tech-Enabled Facilities

Building design should embed operational efficiency from day one, especially as REITs increasingly operate with lean staffing models and digital customer access.

Access control infrastructure: Provision conduit, data cabling, and power for keyless entry systems at gates, building entries, and individual unit doors; coordinate with preferred technology vendors early to avoid late-stage change orders

Camera and security coverage: Plan camera locations during design to ensure complete coverage of hallways, loading areas, elevators, and building perimeter; size IT rooms appropriately for NVR equipment and network infrastructure

Office and reception design: Size the office appropriately for on-site or part-time managers; include retail display space for boxes, locks, and packing supplies; design secure back-office areas for cash handling and records storage

Loading areas: Provide covered loading bays where feasible to protect customers from weather; size dock heights appropriate for box trucks and consumer vehicles; design interior vestibules for climate controlled facilities to maintain temperature integrity

Building automation: Integrate HVAC controls, lighting, and access systems into a unified management platform that enables remote monitoring and reduces long term maintenance costs

Sustainability features: Consider LED lighting throughout, solar-ready roof structures, and energy-efficient HVAC to reduce operating costs and support REIT ESG commitments

Storage Building Company can coordinate with the REIT’s preferred technology vendors during design so that access control, security, and building automation requirements are integrated rather than added as costly change orders during the construction phase.

Step 6: Pre-Construction Budgeting, Scheduling, and Risk Management

By the end of schematic design, the REIT should have a realistic order-of-magnitude budget, preliminary schedule, and risk register before seeking final internal approvals or construction financing. This checkpoint prevents the common mistake of advancing projects with underestimated construction costs or unrealistic timelines.

Pre-Construction Budget Structure:

Site work: Demolition, grading, utilities, stormwater management, paving, landscaping (often 10–15% of hard costs)

Building shell: Foundations, structural steel, exterior envelope, roofing

Interior build-out: Corridors, unit partitions, doors, finishes

MEP systems: HVAC for climate controlled storage, electrical systems, plumbing, fire protection

Vertical transportation: Passenger and service elevators (long lead time item—order early)

Security and technology: Access control, cameras, building automation, IT infrastructure

Soft costs: Architecture, engineering, permits, legal, financing costs, pre-opening expenses (typically 5–10% of project value)

Budgeting for self-storage construction should include a 4%–8% contingency fund for unforeseen costs.

Current 2024–2025 market conditions show continued volatility in steel, concrete, and labor pricing. Relying solely on historical benchmarks without real-time subcontractor input leads to budget surprises. Storage Building Company’s bidding network provides current pricing across trades. Construction costs for single-story self-storage facilities typically range from $25 to $42 per square foot, while multi-story self-storage facilities generally cost between $45 and $75 per square foot to build.

Cash Flow and Draw Schedule Alignment:

Phase capital deployment across: land closing, entitlement period, design completion, site preparation, vertical construction, FF&E, and pre-opening marketing

Align draw schedules with lender requirements; understand upfront investment requirements before construction loan funding

Model interest carry during construction and lease-up periods with realistic assumptions

Schedule Planning Benchmarks:

The construction timeline for a self-storage facility typically ranges from 9 to 12 months. Allowances for seasonal weather, utility company lead times, elevator delivery schedules, and inspection bottlenecks should be built into every schedule. Building materials with long lead times must be identified and ordered early.

Formal Risk Register Items:

Entitlement risk: Hearing delays, condition requirements, appeal potential

Geotechnical surprises: Rock, unsuitable soils, contamination requiring remediation

Utility relocation: Unexpected conflicts with existing infrastructure

Interest-rate shifts: Impact on construction loan costs and refinancing assumptions

Supplier constraints: Elevator lead times (often 20–30 weeks), specialty steel components, climate control equipment

Market shifts: Changes in local demand or competitive supply during the development process

A thorough site evaluation is critical to uncover potential construction obstacles before they become expensive problems. Conducting a thorough geotechnical survey is essential before finalizing a self-storage construction budget. Effective pre-construction planning is the best defense against future budget overruns and delays.

Early coordination with Storage Building Company can mitigate or price these risks through constructability reviews and alternative design solutions.

Value Engineering Without Compromising Brand Standards

Value engineering should refine the project, not simply cut quality that affects customer satisfaction or long-term NOI.

Structural optimization: Refine bay spacing and floor-to-floor heights to reduce steel tonnage without sacrificing usable height; standardize details across floors

Cladding value engineering: Substitute building materials strategically—limit premium façade treatments to high-visibility elevations while using cost-effective alternatives on secondary faces

Geometry simplification: Reduce building complexity (jogs, setbacks, roof variations) that drive steel fabrication and erection costs

MEP right-sizing: Size HVAC systems based on actual climate control needs and anticipated operating hours; avoid overdesign that inflates both capital and operating expenses

Amenity ROI analysis: Evaluate whether premium elements (glass curtainwall vs. economized façade segments, enhanced elevators vs. code-minimum) generate sufficient rent premiums to justify cost

Storage Building Company works collaboratively with REIT asset and operations teams to prioritize VE items that protect customer experience and maximize revenue potential while trimming non-essential spend. The goal is control costs without compromising the attributes that support premium rental rates and high occupancy.

Step 7: Assembling the Right Pre-Construction Team

The most efficient storage facility construction projects are those where the REIT selects a specialized self storage contractor early and builds an integrated team around them, rather than hiring each discipline in isolation. A coordinated construction team with self storage experience avoids the learning curve that inflates costs on complex process projects.

Core Team Members:

REIT development lead: Project champion responsible for internal approvals, capital allocation, and stakeholder communication

Storage Building Company (design-build or CM at-Risk): Specialized construction partner providing constructability input, cost estimating, and schedule management from early design through completion

Self storage architect: Firm with demonstrated multi-story storage experience; ideally has existing building type libraries that accelerate design

Civil engineer: Site design including grading, drainage, utilities, and stormwater management

Geotechnical engineer: Subsurface investigation and foundation recommendations

Land-use attorney: Entitlement strategy, variance applications, hearing representation

Traffic consultant: Trip generation studies and access design

Specialty subcontractors: Elevator, fire protection, and access control vendors engaged early for input on design and lead times

Advantages of Early Contractor Involvement:

For those considering a new project, understanding the costs and planning involved in building a climate-controlled self-storage facility can illustrate why bringing contractors into the process early provides significant value.

Quick constructability reviews identify impractical design details before they’re drawn

Realistic cost input during schematic design prevents budget surprises at bidding

Identification of permitting red flags that pure design professionals may miss

Schedule input based on actual market conditions for labor and materials

Consistent communication between design and construction prevents coordination gaps

Governance and Decision-Making:

Establish regular design coordination meetings (biweekly during active design, monthly during entitlements)

Maintain formal decision logs documenting program changes and their cost/schedule impacts

Implement change-control procedures to prevent scope drift between entitlement drawings and construction documents

Align REIT acquisitions, development, and operations teams early so design decisions reflect both underwriting assumptions and future operating strategies

Engaging experienced professionals from a general contractor with self storage specialization—like Storage Building Company—as a construction partner during land contract or concept design delivers better outcomes than treating construction as a downstream bidding exercise.

Step 8: Pre-Opening Planning Embedded in Pre-Construction

Pre-construction planning should anticipate pre-opening activities so the new facility can begin lease-up immediately upon receiving a Certificate of Occupancy. Delays between construction completion and operational readiness waste carrying costs and defer revenue potential.

Utility activation: Coordinate electric, gas, water, sewer, and telecom service applications 60–90 days before anticipated need; confirm activation schedules align with commissioning requirements

Broadband and security monitoring: Execute contracts for internet service and alarm monitoring with sufficient lead time for installation during construction

City inspections: Schedule final building, fire, and health inspections in sequence to avoid delays; maintain relationships with inspectors throughout construction

Signage permitting and fabrication: Monument and building signs often require separate permits with 3–6 month total lead times for approval and fabrication; initiate early

Digital marketing: Begin local SEO efforts, Google Business Profile setup, and aggregator listings 3–6 months before opening to build online presence

Staffing and training: For REIT-owned and third-party-managed facilities, complete hiring and training before opening; develop training manuals tailored to the building’s specific features

Operational protocols: Establish remote monitoring procedures if using unmanned or hybrid models; design move-in workflows that leverage the building’s loading and access features

Systems testing: Commission access control, cameras, HVAC, and elevators with sufficient time to resolve issues before first customers arrive

Storage Building Company can provide a structured pre-opening checklist tied back to construction milestones, reducing surprises in the last 60–90 days before launch. This coordination ensures that the solid plan developed during pre-construction translates into a successful opening that maximizing revenue from day one.

Partnering with Storage Building Company for Your Next Self Storage Investment

Multi-story self storage pre-construction planning is a complex process involving interlocking decisions about entitlements, design, cost, and operations that unfold over 18–30 months. Mistakes made early in feasibility, site selection, or design are expensive to fix later—often adding months to schedules and hundreds of thousands of dollars to budgets. The storage industry has evolved, and building a self storage facility today requires specialized expertise that generalist contractors simply don’t possess.

Storage Building Company specializes in multi-story, climate controlled self storage construction across institutional-scale self storage projects. The team has extensive experience coordinating with REIT investment committees, construction lenders, and third-party management platforms to deliver facilities that meet underwriting assumptions and operational requirements. From the first test fit on a potential site through final punch list, Storage Building Company serves as a true partner focused on protecting your investment returns.

Engage early: Contact Storage Building Company during land identification or early due diligence so the team can assist with test fits, preliminary budgets, and high-level schedule assessments before earnest money goes hard

Collaborative approach: Storage Building Company works alongside your acquisitions, development, and operations teams rather than waiting for completed drawings

Market experience: Active in major growth markets including Dallas–Fort Worth, Atlanta, Denver, Phoenix, and other high-demand MSAs

Ready to discuss your next project? Visit www.storagebuildingcompany.com or contact the pre-construction team directly to review a current or upcoming self storage site. Storage Building Company can prepare a preliminary pre-construction roadmap tailored to your project’s specific requirements, helping you move forward with confidence.

In competitive markets and evolving interest-rate environments, disciplined pre-construction planning with a specialized construction partner remains one of the most reliable ways to protect spreads, hit projected returns, and deliver storage remains profitable for years to come.

Construction Management: Bridging Planning and Execution

Construction management is the linchpin that connects the strategic vision of self storage pre construction planning with the tangible reality of a completed storage facility. In the self storage industry, effective construction management ensures that every phase of storage construction—from initial site preparation to final inspections—proceeds smoothly, efficiently, and in alignment with the project’s financial and operational goals.

At its core, construction management for self storage projects involves orchestrating a complex process that brings together architects, engineers, subcontractors, and local authorities. The construction manager is responsible for translating the project’s design and development plan into a fully operational self storage facility, ensuring that every detail meets the required building codes, quality standards, and customer expectations. This includes overseeing site preparation, managing permitting and compliance, and coordinating the installation of critical features such as climate controlled units, security systems, and drive up access.

One of the primary advantages of dedicated construction management is the ability to control costs throughout the development process. By carefully selecting building materials and construction methods—such as leveraging pre engineered metal buildings for speed and cost efficiency—construction managers help keep construction costs in check while maintaining the durability and operational efficiency of the facility. They also focus on minimizing long term maintenance costs and operating expenses by specifying energy-efficient systems, robust security features, and durable finishes that stand up to the demands of the storage industry.

Construction management also plays a pivotal role in ensuring that the storage facility is tailored to local demand. Through ongoing market research and close collaboration with the development team, construction managers can recommend adjustments to the unit mix, such as increasing the proportion of climate controlled units in markets where premium rental rates are achievable, or incorporating drive up access where customer convenience is a critical factor. This adaptability is essential for maximizing rentable square footage and revenue potential in a competitive market.

Operational efficiency is another key consideration. Construction managers work to ensure that the building design supports smooth day-to-day operations, from optimizing loading zones and elevator placement to integrating advanced security features and building automation systems. Their expertise helps deliver a storage facility that not only meets but exceeds customer expectations, supporting high occupancy rates and strong financial performance.

Given the complexity of self storage construction, it is essential to partner with an experienced construction manager who understands the unique requirements of the storage industry. The right professional will have a proven track record with self storage projects, deep knowledge of pre engineered metal buildings, and a thorough understanding of the development process from pre construction through project completion. Their ability to anticipate challenges, coordinate stakeholders, and maintain consistent communication is critical to delivering a successful self storage project on time and within budget.

In summary, construction management is the bridge that transforms a solid plan into a thriving self storage facility. By controlling costs, ensuring compliance, and adapting to market demand, effective construction management safeguards your investment and positions your new self storage facility for long-term success in a dynamic and growing industry.